Performance

Strong Financials, Sustainable Growth.

Our Performance

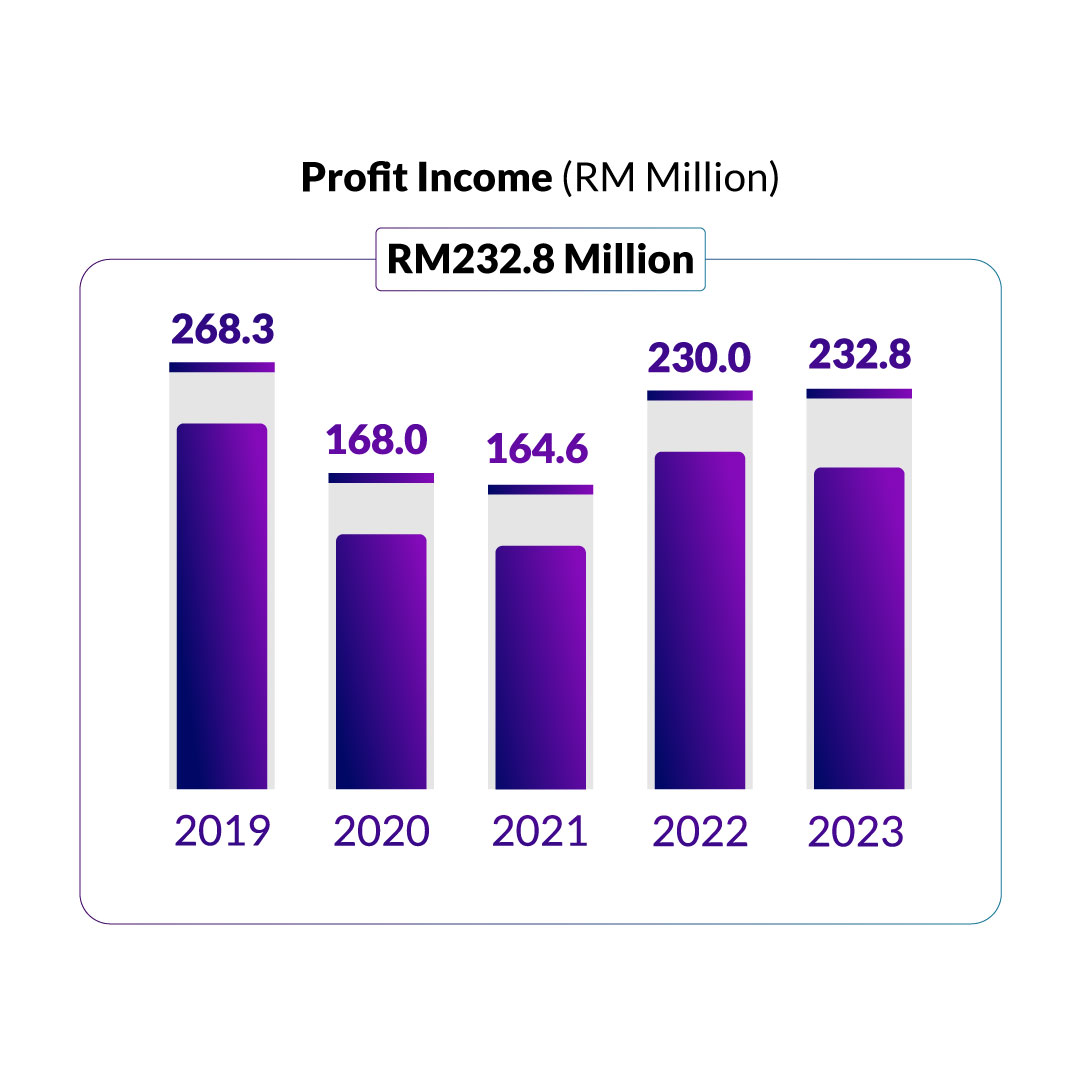

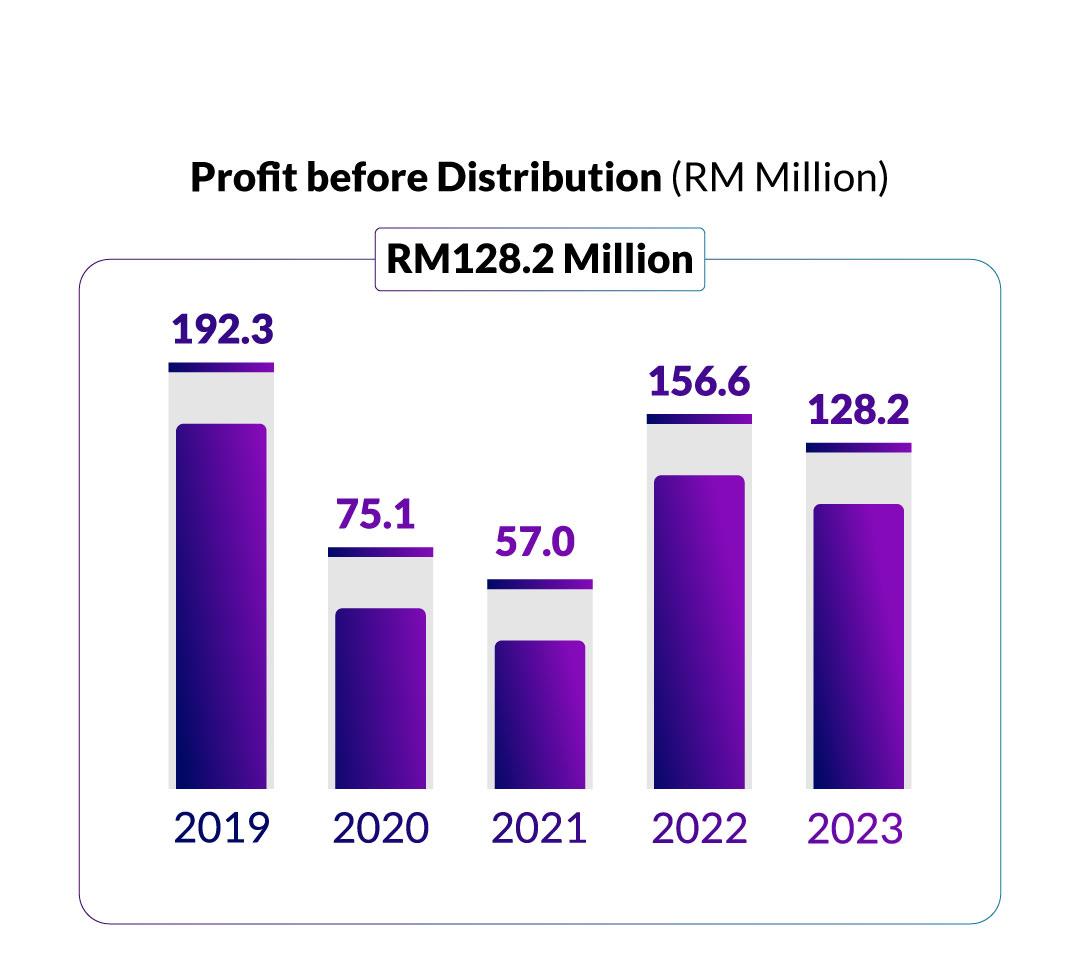

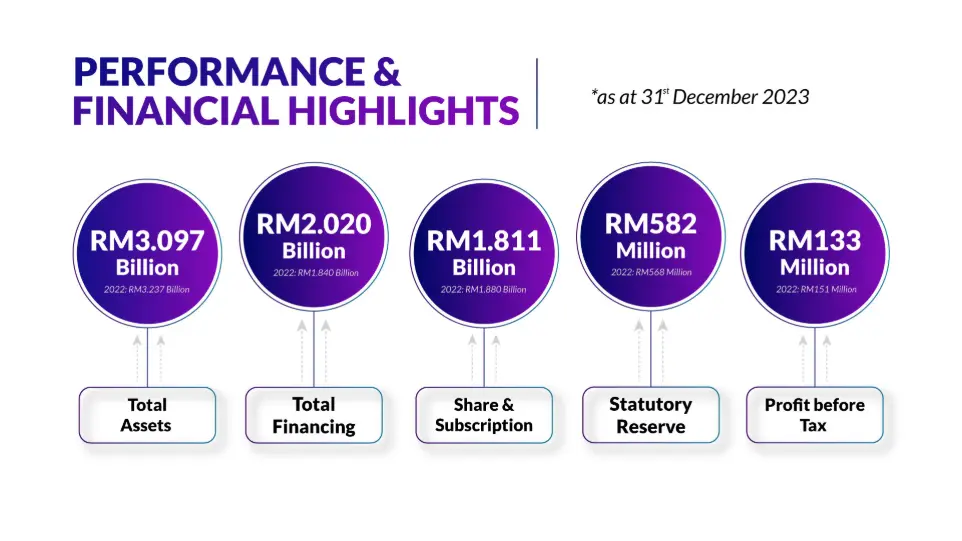

FINANCIAL HIGHLIGHTS

With some 64 years to its name, Koperasi Tentera has time and time again proven its value as an attractive investment proposition. Today, we continue to build upon our strong foundations and progressively transform ourselves into one of the nations’ leading credit cooperatives whiles steadfastly serving our more than 156,000 members.

As of 31 December 2023, we have had the privilege of serving 155,732 members comprising Malaysian Armed Forces (ATM) personnel and civil servants working under the Ministry of Defence. Our total assets as of end 2023 stood at RM3.097 billion, while the share capital and accumulated fees contributed by members amounted to RM1.811 billion.

As we work hard to live up to our mandate of being an attractive investment proposition for our members and stakeholders, rest assured we will bring all our resources to bear to build true and lasting value.

GOOD VALUE CREATION

Despite a highly competitive and challenging operating environment, we continue to strengthen our asset portfolio and deliver good returns to our members. As of 31 December 2023, we have grown the assets under our care to approximately RM3 billion and have maintained an average dividend pay-out ratio of 75% of our earnings each year for the last two decades.

Our success comes on the back of the successful rollout of focused transformation initiatives. We also continue to be guided by the values of integrity, diligence and professionalism, while good governance, a high-performance work culture, technological prowess and healthy performance ethics are propelling us forward.

To date, Koperasi Tentera has progressively expanded to better accommodate and serve its members with the opening of 24 branches, 2 kiosk and 10 Ar-Rahnu across Malaysia.

Koperasi Tentera offers a variety of services to its members such as shariah-compliant financial products – personal and express, fees financing, Takaful financing; Insurance products – ATM Group Takaful scheme, Perwira II Takaful Scheme, KT Medic Scheme and Motor Insurance and Ar-Rahnu (Islamic pawn financing).

In addition, Koperasi Tentera also provides welfare assistance to ease the burden borne by the members. For this purpose, Koperasi Tentera has allocated RM2.5 million to be distributed to members and their families through a number of schemes and contributions provided annually.

Koperasi Tentera is also involved in selected strategic investment activities with the aim of generating a sustainable investment income and the preservation of capital by taking into account the risk – benefit considerations. Our major strategic investments are of 100% equity in Wira Maju, 30% equity Great Eastern Takaful and 30% ekuiti in Desatera.